The Envelope System

by

Fri Feb 09 2024

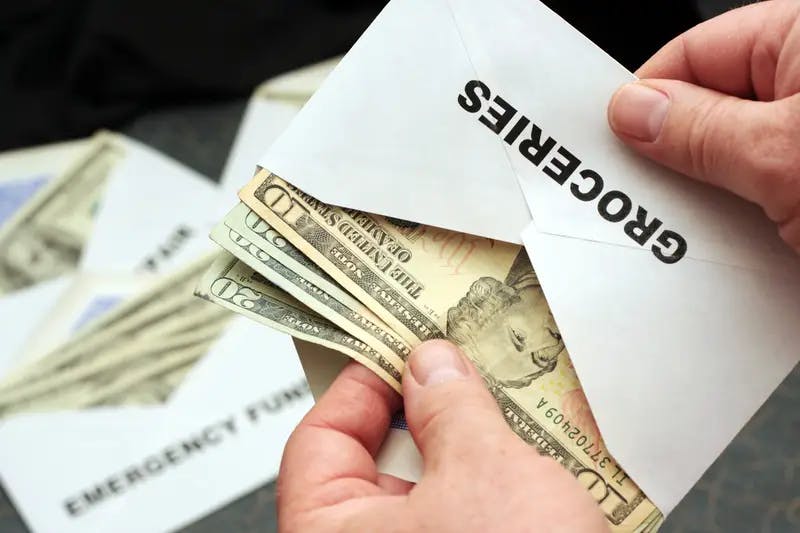

While digital saving strategies emerge and take over modern budgeting techniques, an old callback to the envelope system may be just what you need to stick to your budget. The envelope system requires taking out cash to cover all expenses and dividing the cash into spending categories.

People have used the envelope system to save and pay off debt for decades. The visual depletion of money helps people see how much money they have left to spend. When the envelope is empty, the money is gone. This article explores the envelope system's origins, how it works, its benefits, and how to implement it in today's digital world.

The History of the Envelope System

The envelope system dates back to a time when cash transactions were more common than credit cards. It gained prominence during periods of economic hardship, like the Great Depression, as a way for people to control their spending and live within their means.

How to Get Started with the Envelope System

Dealing with hard cash sets limits on the way you spend. You may experience increased motivation to spend less and save more. Let us help you get started.

- Identify Your Budget Categories: Start by identifying your main spending categories. Common categories include groceries, gas, entertainment, and dining out.

- Allocate Your Budget: After receiving your paycheck, allocate a predetermined amount of cash to each category based on your budget.

- Fill Your Envelopes: Place the allocated cash in the corresponding envelopes.

- Spend According to the Envelopes: Use the cash from these envelopes for your expenses. Once an envelope is empty, you can't spend any more in that category until you refill it in the next budget cycle.

- Adjust as Necessary: At the end of each cycle, review and adjust your allocations based on your spending habits and needs.

The Benefits of the Envelope System

You will only know if the envelope system is right for you after you try it. How does it feel to carry cash everywhere? What are the limitations? What are the benefits?

- Simple and Tangible: The physical act of handling cash makes you more aware of your spending.

- Prevents Overspending: Once an envelope is empty, you can't spend more in that category, preventing impulse buys.

- Easy to Track: It’s easier to track your spending when you can see the physical cash decreasing.

- No Debt Risk: Using cash eliminates the risk of credit card debt.

- Encourages Savings: Any leftover money can be saved for future goals.

Tips for Customizing the Envelope System

In order to increase your chance of success, you need to implement the system to fit your lifestyle. An unrealistic budget or lopsided category allocation will lead to frustration and failure. Here are some tips to follow:

1. Set Realistic Budgets: Base your budget on your actual spending patterns and income.

2. Customize Your Categories: Tailor your categories to reflect your lifestyle and spending habits.

3. Regular Reviews: Regularly review and adjust your budgets and categories as your financial situation changes.

4. Be Consistent: Consistency is key to making the envelope system work.

5. Combine with Other Methods: You can combine the envelope system with other budgeting tools like digital tracking for a comprehensive approach.

Choosing the Right Budgeting App: A Comprehensive Guide

A Comprehensive Guide

Modern Adaptations of the Envelope System

Adapting the envelope system to include digital transactions is possible. Modern technology opens up opportunities for online shopping and tracking through apps rather than envelopes. Adapt the method to your liking.

1. Digital Envelope Apps: There are several apps designed to mimic the envelope system digitally, allowing you to allocate and track your spending in virtual envelopes.

2. Hybrid System: Use a combination of cash and digital transactions. You can have physical envelopes for day-to-day expenses and a digital system for fixed expenses like rent and utilities.

3. Prepaid Debit Cards: Use prepaid debit cards for different categories. Once the balance on a card is depleted, you stop spending in that category.

Challenges and Solutions

Be prepared for unexpected challenges once you start the envelope challenge.

- Carrying Cash: In an increasingly cashless society, carrying cash can be inconvenient. A hybrid system can alleviate this issue.

- Unexpected Expenses: Create an envelope for unexpected expenses or emergencies.

- Online Shopping: Use prepaid debit cards or a dedicated online shopping envelope.

Tips for Success with the Envelope System

Stay on track and work slowly toward your goals. You cannot pay off debt or increase savings overnight. It takes consistent discipline and budgeting.

- Stay Flexible: Be prepared to adjust your budget categories and amounts.

- Include Your Family: If you have a family, involve them in the process. It can be a valuable financial lesson for children.

- Reward Yourself: Occasionally, use any surplus from your envelopes to treat yourself, reinforcing positive budgeting habits.

- Regular Check-Ins: Have regular check-ins to assess your progress and make necessary adjustments.

Incorporate the Envelope System into a Frugal Lifestyle

The envelope system can seamlessly align with your frugal lifestyle. As you simplify your spending and eliminate unnecessary expenses, the envelope system will help you streamline your budgeting goals. Use this system to prioritize your spending and focus on what’s truly important.

The envelope system is a time-tested budgeting method that offers a simple, effective way to manage your finances. Its physical and tangible nature makes it an excellent tool for those seeking to control their spending and live within their means. Whether used in its traditional form or adapted for the digital age, the envelope system can be a cornerstone of a responsible, frugal lifestyle.