How to Set SMART Financial Goals for Your Budget

byFrugal and Simple

Sun Jan 28 2024

Creating a budget is the first step to saving money. But how can you set goals that you’ll actually keep? Follow the outline for SMART goals to set milestones that are specific to your needs.

SMART goals come from an acronym: Specific, Measurable, Achievable, Relevant, and Time-bound.

Let’s explore how to apply the SMART framework to set effective financial goals that align with your budget.

Breaking Down SMART Goals

Dive into the SMART goal framework to brainstorm ideas that fit into the categories. Let’s talk about each letter in the acronym:

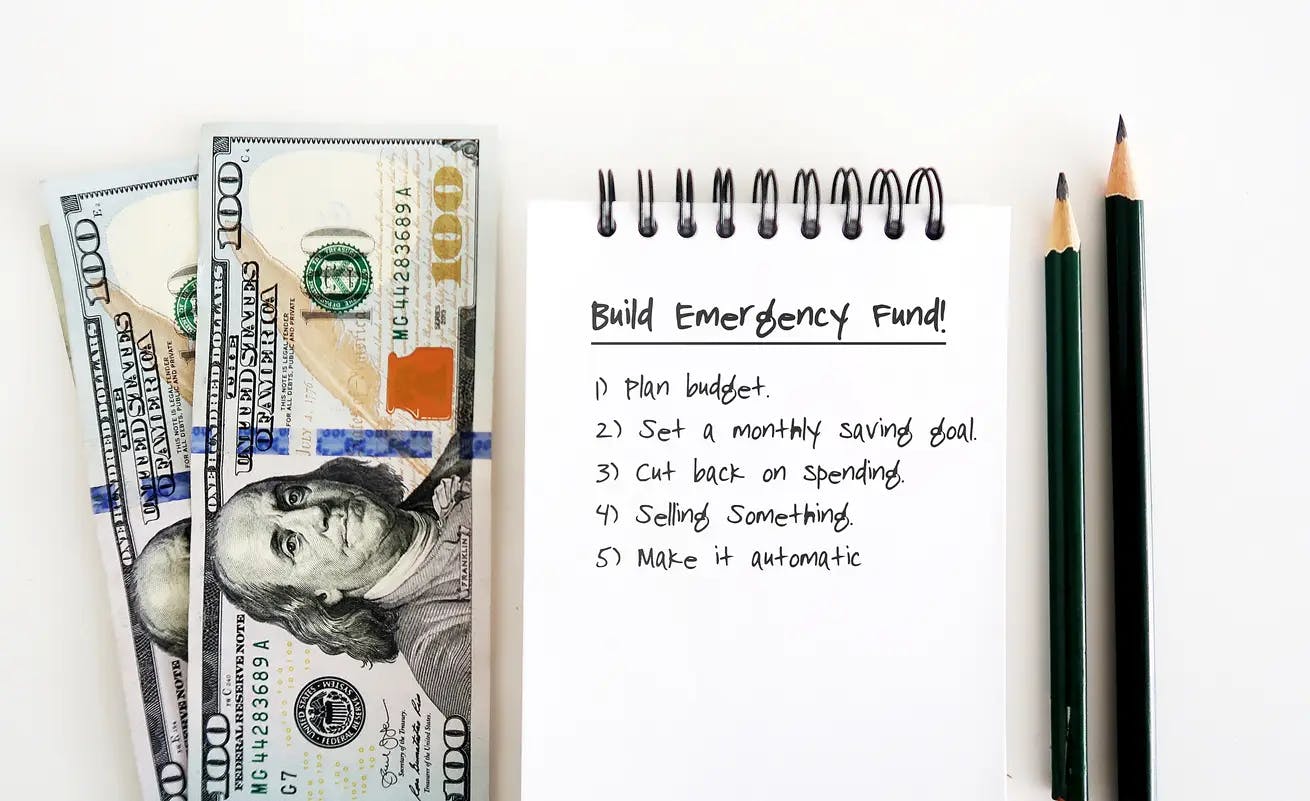

Specific: Broad goals like 'save more money' are less effective than specific ones. For instance, decide to save $200 monthly towards an emergency fund. Specificity gives your goal clarity and direction.

Measurable: For tracking and analyzing progress, your goal must be quantifiable. Instead of simply aiming to 'reduce debt,' plan to pay off $500 from your credit card balance every month. Measurability keeps you accountable.

Achievable: Make obtainable goals considering your income, expenses, and lifestyle. Overambitious goals can lead to frustration, whereas achievable goals boost confidence and commitment. Focus on one area of your budget at a time, then add a new element once you master the first part.

Relevant: Your budget limitations should align with your personal values and long-term objectives. For instance, saving for retirement may be more relevant than buying a luxury car.

Time-bound: Choose a due date for your goals. Whether saving for a vacation next summer or paying off a loan in three years, time constraints provide motivation and a sense of urgency. Setting smaller chunks of time limits will give you a reason to check in and see if you need to change any of your goals.

Once you have a list of goals that fit into these categories, choose the ones that align the most with where you want to be one year from now. Do you want to pay off a debt? Do you want to grow your savings? Commit to the goals that will get you there.

How to Create a Realistic Budget for Your Frugal Lifestyle

Applying SMART Goals to Your Budget

When I set new budgetary goals, I follow the SMART framework. With achievable, specific goals in front of me, I am more likely to succeed. Increasing my grocery budget to include foods I’m excited about helps me stick to my goal of eating out only once per week. I still spend way less than I would out at a restaurant, but I can have more exciting meals at home.

Once you choose your set of goals that are representative of each category, you can apply them to your budget and see what it’s like to live according to the goals you’ve set.

Budget Analysis: Take a look at the money coming in and money going out. Identify areas where you can cut back and redirect funds toward your goals.

Goal Prioritization: Make a list of your priorities and desired outcomes. What is at the top of the list according to urgency and importance? Emergency funds and debt repayment often top the list.

Actionable Steps: Spell out what you need to do to achieve your budget goals. Break down larger goals into smaller steps. For example, if you aim to save $2,400 in a year, focus on the $200 monthly goal.

Tools and Resources: Tap into a world of resources available to you. Utilize budgeting apps or financial planning tools to track your progress. Many tools offer categorization of expenses, reminders, and motivational charts.

Once you set yourself up for success with your goal planning, you will feel more confident as you start to apply the goals.

Overcoming Challenges and Staying Motivated

Along with making a plan to stick to your budget, make a plan for the times you stray from your budget. Give yourself grace and reset. Make a plan to expect the unexpected.

Common Obstacles: Unpredictable income, unexpected expenses, and maintaining discipline are common hurdles. Create a flexible budget that can adapt to changes in your financial situation.

Adjusting Goals: Life throws you through a loop sometimes. Be prepared to reassess and adjust your goals as necessary. Flexibility doesn’t mean failure; it means you’re responsive to life’s changes.

Celebrating Milestones: Record the progress you’ve made and celebrate when you reach a milestone. This keeps the journey toward financial well-being enjoyable and motivating.

You are human, and every goal will not be marked with 100% success. That’s okay. Celebrate the progress you make and continue on an improved path each day.

Set Yourself Up for Success with SMART Goals

Setting SMART financial goals is a dynamic and empowering process. It’s about making your money work effectively for you. Start by assessing your current financial situation, setting specific and achievable goals, and staying disciplined in your approach.

Remember, the journey to financial stability and freedom is a marathon, not a sprint. Celebrate your progress, learn from the setbacks, and keep moving forward. Let’s make your financial goals a reality, one SMART step at a time.